From Adversity to Competitive Advantage: How Auto Parts Companies Are Reinventing Themselves

The global auto parts sector has shown a more robust recovery compared to OEMs.

In Brazil, we have observed that several component manufacturers have shown significant improvements in their key financial results, such as net revenue and EBIT.

Short-term vehicle sales projections indicate stagnation, still as a consequence of the pandemic, disruptions in the supply chain, and difficulties in financing. Specifically, the outlook by segment indicates that:

- Light vehicles will have sales at levels similar to those of 2022;

- High inventories of Euro V vehicles at the beginning of the year limit truck sales;

- Road implements are expected to see a decrease in sales due to the increase in steel costs and the maintenance of interest rate projections, which hinder financing;

- Agricultural and construction machinery show a slight decrease compared to 2022, which was a year of high sales due to record harvest and increased infrastructure investments, respectively;

- Buses are the only segment with an optimistic projection, due to expectations of a tourism rebound and the federal program “Caminho da Escola” (Road to School).

In this context, with limited growth in new vehicle sales, fleet aging is expected, benefiting the auto parts sector. As a result, the sector will grow by 10% compared to 2022, reaching revenues of R$ 203 billion.

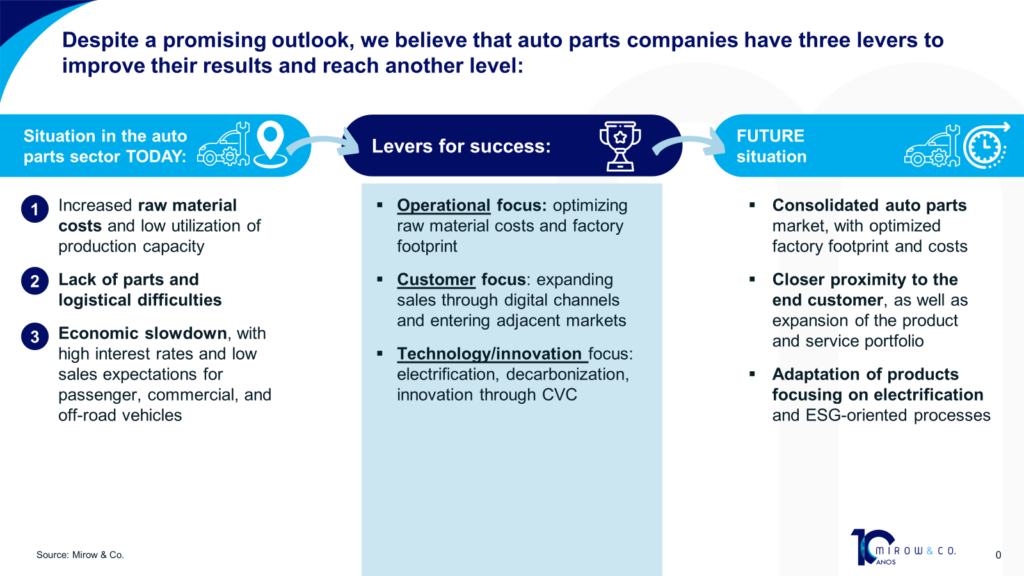

Nevertheless, the sector still faces three major cyclical challenges: increased costs combined with low utilization of production capacity, continued component shortages, and economic slowdown.

To address these challenges, we believe that companies should work on three improvement levers:

- Operational focus

- Costumer focus

- Technology focus

Operational Focus

We have observed that companies in the sector, such as Tupy, Iochpe-Maxion, and Randon, have experienced an increase in their raw material costs. The representativeness of raw material costs in the total cost jumped from about 50% in 2020 to the range of 60% to 75% in 2022. This effect is aggravated by the concentration existing in the producing markets of the main commodities used:

- Steel production is concentrated among six players in Brazil: ArcelorMittal, Gerdau, Ternium, CSN Usiminas, and CSP;

- Aluminum is predominantly produced by two players: CBA and Albras;

- And finally, polypropylene supply is concentrated among three players: Braskem, LyondellBasell, and Total Petrochemical & Refining.

Another factor is the better utilization of factories in the auto parts sector – during the pandemic, capacity utilization reached 45%, but it has already returned to historical levels of 75%.

By working to reduce raw material costs and optimize factory footprint, companies will be able to address current operational challenges and, at the same time, seize opportunities to strengthen their competitiveness in the auto parts market.

Customer Focus

In Focusing on the customer, we identify two specific movements in the aftermarket:

- Expansion of sales channels to online platforms: vehicle assemblers have created electronic portals focused on the aftermarket, and major B2C channels, such as Amazon and Mercado Livre, already offer a portfolio of spare parts. Additionally, other smaller multi-brand channels, such as Auto Experts and Canal da Peça, have emerged;

- Creation of a second brand for the aftermarket: vehicle assemblers have created second brands, such as Mercedes Benz (Alliance) and Renault (Motrio). This allows vehicle assemblers to reach different customer segments, especially those more sensitive to price, thereby increasing their market share. Additionally, this strategy allows for greater access to other distribution channels, including distributors, retailers, and marketplaces that do not carry their main brand;

Another trend is the emergence of different “as-a-service” models – in 2022, for example, Randon and Gerdau joined forces to create a joint venture to offer heavy vehicle rental services.

These trends indicate a movement of adaptation and innovation on the part of companies in the sector, aiming to meet the demands of new customer profiles and maintain competitiveness in an evolving sector.

Technology and Innovation Focus

The share of electric and hybrid vehicles in the national fleet is growing, and it is expected to reach 30% of sales by 2030. This increasingly prompts auto parts manufacturers to develop specific solutions for the segment.

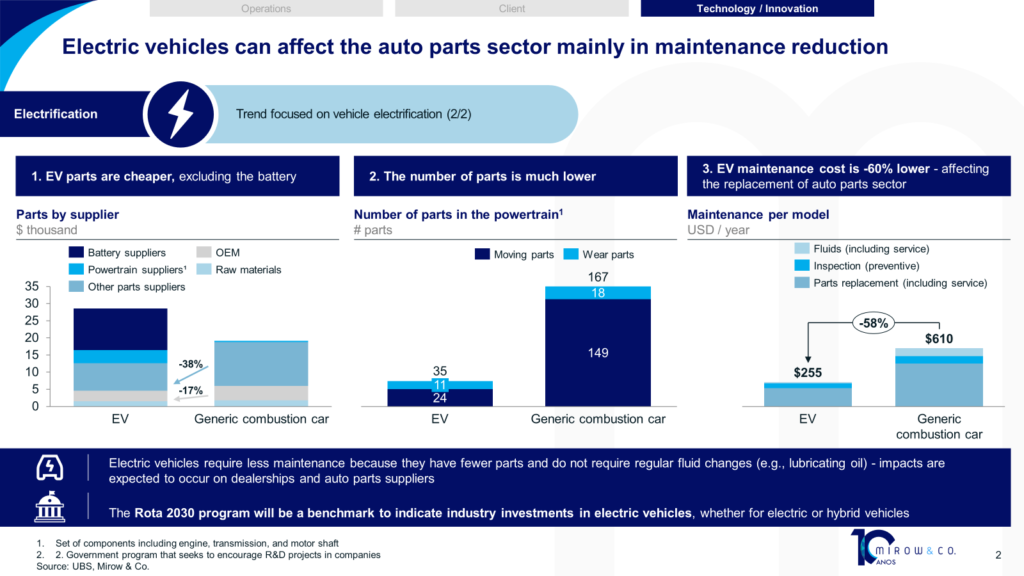

The increased share of electric and hybrid vehicles affects the auto parts industry in three ways:

- Parts are cheaper compared to combustion vehicles (with the exception of the battery);

- The number of parts required in the powertrain decreases considerably (with up to an 80% reduction in the number of components);

- Cheaper parts and a smaller number of parts reduce maintenance costs by up to 60%.

Another relevant trend is decarbonization. Sector-leading companies have announced initiatives focused on developing new materials and products to reduce greenhouse gas emissions.

Randon has adopted the use of solar panels and reduced the need for welding in manufacturing, which reduces fuel consumption. Fras-Le, from the same group, is developing new materials to minimize the use of steel, also contributing to emission reduction. Finally, Tupy has been investing in the development of hydrogen combustion engines and battery recycling.

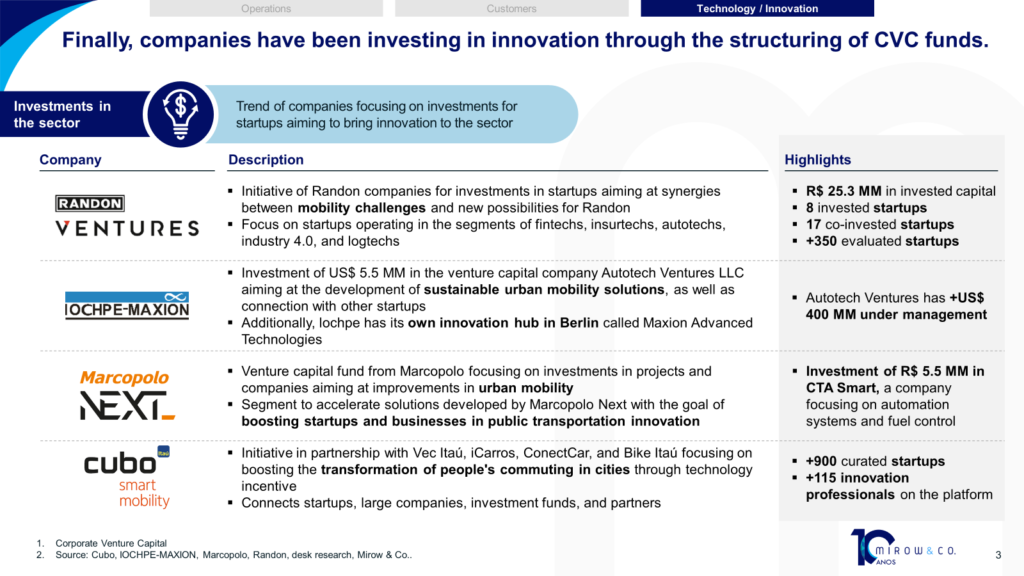

To conclude our vision on technology and innovation, we highlight that more and more companies in the sector have been structuring investments in startups through Corporate Venture Capital (CVC) funds. The main reasons for conducting this type of investment are:

- Strategic benefits: companies can gain access to new technologies, products, and markets, as well as get closer to emerging trends and innovations;

- Financial returns: early-stage investments can bring significant capital gains, as well as create an additional source of revenue;

- Talent acquisition: CVC investments help companies identify and attract talent that can work in technology or innovation areas.

In auto parts, Randon, Iochpe-Maxion, and Marcopolo have already stood out in this growth avenue through different initiatives, as we can see below:

The advances in the auto parts sector in technology and innovation demonstrate an effort to keep up with the automotive sector’s journey towards electrification and the industrial sector’s journey towards decarbonization. The success of the sector in such a transition is related to the continuity of investments in R&D, the promotion of new strategic partnerships, and the adaptation of supply chains to support new technologies and the use of new materials.

Returning to our vision of improvement levers, auto parts companies can achieve a new level of profitability through some actions.